As Cash Offer vs. Mortgage: Best Way to Buy a Home in Georgia in 2026 takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this article, we will delve into the key differences between cash offers and mortgages when it comes to purchasing a home in Georgia in 2026.

Overview of Cash Offer vs. Mortgage

When it comes to buying a home in Georgia, there are two primary methods of payment - cash offer and mortgage. Each option has its own set of advantages and disadvantages that potential buyers should consider before making a decision.

Cash Offer

A cash offer in real estate refers to when a buyer offers to purchase a property outright with cash, without the need for a mortgage or financing. This type of transaction can be appealing to sellers as it eliminates the risk of the deal falling through due to financing issues.

Mortgage

On the other hand, a mortgage involves borrowing money from a financial institution to purchase a home. The buyer makes a down payment and then repays the loan amount plus interest over a set period of time. This allows buyers to spread out the cost of the home over several years.

Advantages and Disadvantages

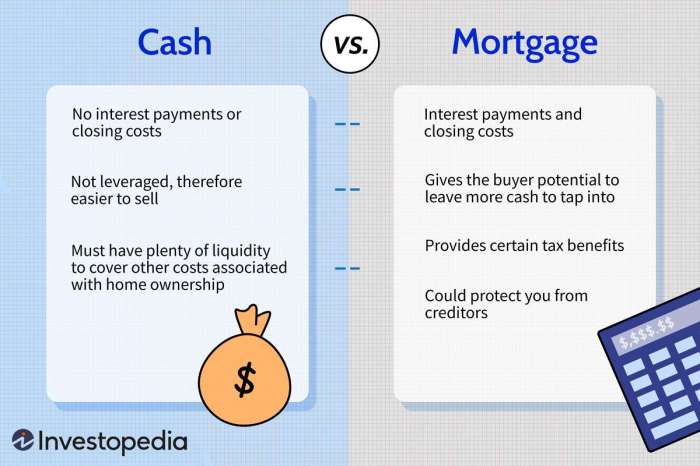

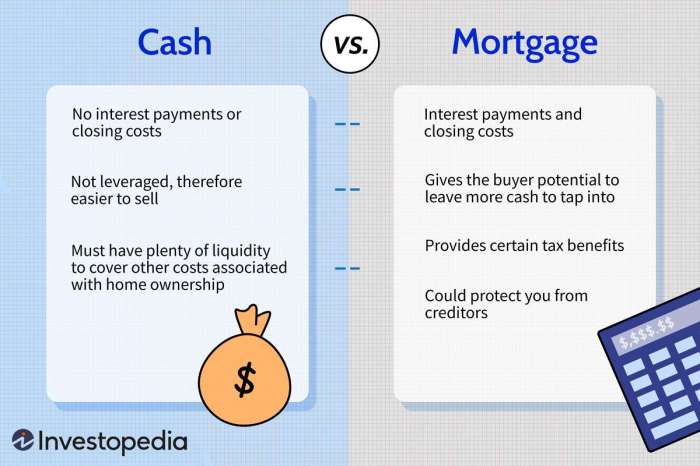

- Advantages of Cash Offer:

- Quick transactions: Cash offers can often lead to faster closings as there is no need to wait for loan approval.

- No interest payments: Buyers save money on interest payments that would come with a mortgage.

- Strong negotiating power: Sellers may be more inclined to accept a cash offer due to the certainty of payment.

- Disadvantages of Cash Offer:

- Tie up cash: Buying a home with cash ties up a significant amount of liquid assets.

- Miss out on tax benefits: Mortgage interest is tax-deductible, which cash buyers do not benefit from.

- Advantages of Mortgage:

- Preserve cash flow: By financing the home, buyers can preserve their cash for other investments or emergencies.

- Build credit: Making mortgage payments on time can help improve the buyer's credit score.

- Tax benefits: Mortgage interest and property taxes are often tax-deductible.

- Disadvantages of Mortgage:

- Interest payments: Buyers end up paying more for the home over time due to interest.

- Risk of loan denial: There is always a risk of loan denial, which could jeopardize the purchase.

Current Real Estate Trends in Georgia

As of 2026, the real estate market in Georgia is showing some interesting trends that potential homebuyers should consider.

Factors Influencing the Decision Between Cash Offer and Mortgage

Several factors play a role in deciding between a cash offer and a mortgage in Georgia:

- The current interest rates: Low interest rates may make a mortgage more appealing, while high rates could push buyers towards a cash offer.

- Market conditions: In a seller's market with high competition, a cash offer may be more attractive to sellers.

- Buyer's financial situation: Cash offers can be advantageous for buyers with readily available funds, while mortgages offer more flexibility for those who need financing.

Economic Conditions Impacting the Choice Between Cash Offer and Mortgage

The economic conditions in Georgia can significantly impact the decision between a cash offer and a mortgage:

- Job market stability: A robust job market may give buyers confidence to take on a mortgage, while uncertainty could lead to a preference for cash offers.

- Economic growth: Strong economic growth may lead to higher home prices, influencing the choice between cash and mortgage financing.

- Tax incentives: Changes in tax laws or incentives for homeownership can also affect the decision-making process for buyers in Georgia.

Legal and Financial Considerations

When deciding between a cash offer and a mortgage to purchase a home in Georgia, there are important legal and financial considerations to take into account. Let's explore the implications of each choice.

Legal Implications of Choosing a Cash Offer

- When opting for a cash offer, the process of purchasing a home may be faster as there is no need to wait for loan approval.

- Seller preferences may come into play, as some sellers prefer cash offers due to the quicker and more secure transaction.

- Without a mortgage, there are no lender requirements or potential complications that may arise during the transaction.

Financial Considerations Between Cash Offer and Mortgage

- With a cash offer, buyers can avoid paying interest on a loan, potentially saving a significant amount of money in the long run.

- On the other hand, taking out a mortgage allows buyers to spread out the cost of the home over time, making homeownership more affordable upfront.

- Buyers should consider their current financial situation, including savings, income stability, and future financial goals when deciding between a cash offer and a mortgage.

Tax Implications of Choosing a Cash Offer or Mortgage

- Choosing a cash offer means buyers may not be able to take advantage of mortgage interest deductions on their taxes, which can be a significant tax benefit for homeowners with a mortgage.

- Buyers should consult with a tax professional to understand the specific tax implications of their choice between a cash offer and a mortgage in Georgia.

Pros and Cons of Cash Offer in Georgia

When it comes to buying a home in Georgia, opting for a cash offer can have both advantages and disadvantages. Here we explore the pros and cons of choosing a cash offer over a mortgage.

Advantages of Cash Offer

- Quick closing process: Cash offers often result in faster transactions since there is no need to wait for mortgage approval.

- Negotiating power: Sellers may prefer cash offers as they are more likely to close and are not contingent on financing.

- No interest payments: By paying in cash, you avoid interest payments over the life of a mortgage.

Disadvantages of Cash Offer

- Tying up cash: Making a cash offer means tying up a significant amount of cash that could be used for other investments or emergencies.

- Lack of liquidity: Once you invest in a home with cash, it may be challenging to access that money quickly if needed.

- No mortgage interest deduction: Without a mortgage, you miss out on potential tax deductions related to mortgage interest payments.

Real-life Examples of Successful Cash Offers in Georgia

One example of a successful cash offer in Georgia is a buyer who was able to secure their dream home in a competitive market by offering cash, giving them an edge over other potential buyers relying on financing.

Another case study involves a seller who preferred a cash offer due to the certainty of the transaction, leading to a smooth and quick closing process for both parties.

Pros and Cons of Mortgage in Georgia

When considering purchasing a home in Georgia, using a mortgage can offer several benefits as well as present some challenges. Here, we will explore the advantages and drawbacks of financing a home through a mortgage, along with tips for navigating the mortgage process effectively in Georgia.

Benefits of Using a Mortgage in Georgia

- Increased Buying Power: A mortgage allows you to afford a more expensive home than if you were to pay with cash upfront.

- Building Equity: As you make mortgage payments, you are gradually building equity in your home, which can be a valuable asset in the long run.

- Tax Deductions: Mortgage interest and property taxes are often tax-deductible, providing potential savings for homeowners in Georgia.

Challenges of Financing a Home Through a Mortgage

- Interest Payments: Over the life of the loan, you will end up paying more in interest compared to a cash purchase, increasing the overall cost of homeownership.

- Qualification Requirements: Lenders have strict criteria for mortgage approval, including credit score, income, and debt-to-income ratio, which can be challenging to meet for some buyers.

- Foreclosure Risk: Failure to make mortgage payments could lead to foreclosure, putting your home at risk of being repossessed by the lender.

Tips for Navigating the Mortgage Process Effectively in Georgia

- Improve Your Credit Score: Work on improving your credit score before applying for a mortgage to increase your chances of approval and secure better terms.

- Shop Around for Lenders: Compare mortgage offers from different lenders to find the best rates and terms that suit your financial situation.

- Understand the Terms: Familiarize yourself with the terms of the mortgage, including interest rates, fees, and repayment schedule, to avoid any surprises down the line.

Tips for Choosing the Best Option

When deciding between a cash offer and a mortgage for buying a home in Georgia, there are several key factors to consider to ensure you make the best choice for your situation.

Guidance on Determining the Best Choice

- Consider your financial position: Evaluate your current financial situation, including available cash reserves, income stability, and credit score to determine if a cash offer is feasible.

- Long-term goals: Think about your long-term financial goals and how a mortgage or cash offer aligns with those objectives.

- Market conditions: Research the real estate market in Georgia to understand trends, interest rates, and property values that may impact your decision.

Strategies for Negotiating a Favorable Deal

- Be prepared to move quickly: If opting for a cash offer, be ready to act fast to secure the property before other buyers.

- Get pre-approved: For a mortgage, obtaining a pre-approval can strengthen your offer and show sellers you are a serious buyer.

- Work with a real estate agent: Enlist the help of a professional who can negotiate on your behalf and provide valuable insights during the buying process.

Checklist of Factors to Consider

- Down payment amount

- Interest rates

- Closing costs

- Loan terms and conditions

- Property condition and appraisal value

- Future financial implications

Last Recap

In conclusion, the debate between cash offers and mortgages for buying a home in Georgia in 2026 is multifaceted, with each option offering unique advantages and drawbacks. By weighing the factors discussed, individuals can make an informed decision tailored to their specific circumstances.

Top FAQs

What are the main advantages of opting for a cash offer when buying a home in Georgia?

A cash offer can often result in a quicker transaction, as there is no need for mortgage approval. It can also give buyers a competitive edge in a hot real estate market.

Are there any tax implications associated with choosing a mortgage over a cash offer in Georgia?

Yes, mortgage interest payments may be tax-deductible, which can provide financial benefits to homeowners.

How can one effectively navigate the mortgage process when buying a home in Georgia?

To navigate the mortgage process effectively, it's important to review your credit score, gather necessary documentation, shop around for lenders, and understand the terms of the loan you're committing to.

When it comes to buying a home in Georgia, there are two primary methods of payment - cash offer and mortgage. Each option has its own set of advantages and disadvantages that potential buyers should consider before making a decision.

When it comes to buying a home in Georgia, there are two primary methods of payment - cash offer and mortgage. Each option has its own set of advantages and disadvantages that potential buyers should consider before making a decision.

When deciding between a cash offer and a mortgage for buying a home in Georgia, there are several key factors to consider to ensure you make the best choice for your situation.

When deciding between a cash offer and a mortgage for buying a home in Georgia, there are several key factors to consider to ensure you make the best choice for your situation.

In conclusion, the debate between cash offers and mortgages for buying a home in Georgia in 2026 is multifaceted, with each option offering unique advantages and drawbacks. By weighing the factors discussed, individuals can make an informed decision tailored to their specific circumstances.

In conclusion, the debate between cash offers and mortgages for buying a home in Georgia in 2026 is multifaceted, with each option offering unique advantages and drawbacks. By weighing the factors discussed, individuals can make an informed decision tailored to their specific circumstances.